AHNTIE 2025

Earlier this week, I attended the Animal Health, Nutrition and Technology Innovation Europe (AHNTIE) conference in London.

This multi-day event includes over 800 attendees from across the animal health industry, covering enterprise businesses, service providers, investors, academics, and over 250 startups.

My company was the headline sponsor, with our CEO Jeff Simmons delivering the keynote as part of a fireside chat.

As a technologist, it was interesting to see the impact of Artificial Intelligence (AI), which was everywhere. Every speaker and conversation referenced AI, with opportunities covering the entire value chain from drug discovery to customer engagement.

Although exciting, it was evident that the animal health industry is still very immature in this area, with clear gaps in understanding and/or a lack of clarity regarding the specifics of how AI could/should be applied.

With that said, it is clear the “mainstream media buzz” has captured the imagination of the industry, which certainly presents an opportunity for technologists to build on this momentum.

Due to the intensity and energy of the event, it is not possible to provide a comprehensive overview. Therefore, I have chosen to summarise a few key messages that resonated strongly with me.

Key Messages

-

The animal health industry is very robust and resilient. It has the potential for sustained year-on-year growth, with a low risk of a “crash”, as seen by other more volatile industries (e.g., DeepSeek and NVIDIA).

-

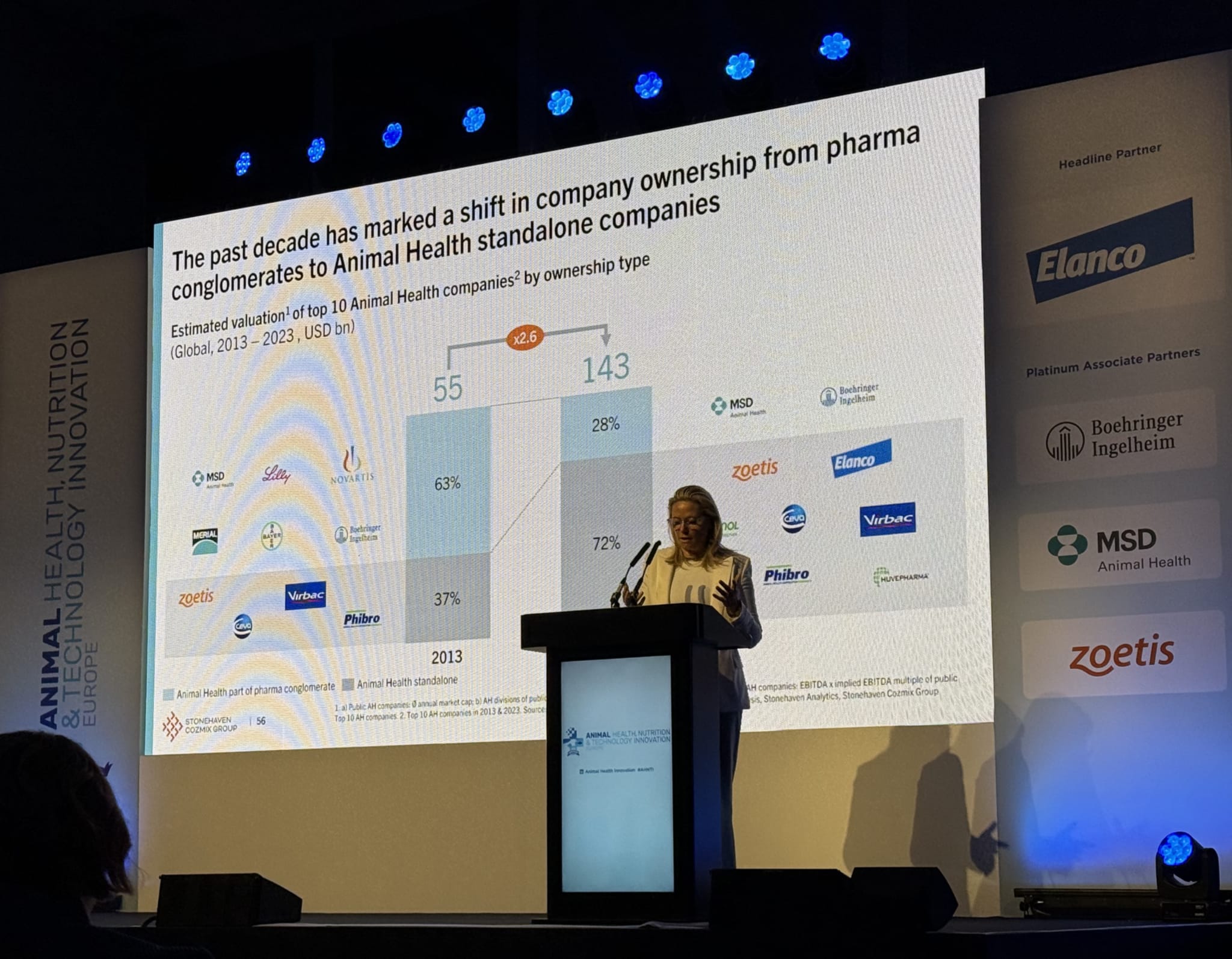

In 2013, standalone animal health companies served 37% of the industry. In 2025, the market has shifted dramatically, with standalone animal health companies representing 72%.

-

We continue to see the humanisation of pets, where animals started outside, migrating inside, and are now in our beds. Pets are increasingly treated as a member of the family.

-

Unlike human health, across pets and farms, customer loyalty is very strong, with examples of 50-year-old products continuing to sell.

-

Pets are living longer, specifically dogs and cats. This is great, but it creates new challenges for old-age care.

-

The veterinary industry is under increasing pressure and overworked (commonly 3 full-time employees per vet practice). Veterinarians desire new ways of working to meet demand. Excitement that Artificial Intelligence (AI) could increase efficiency and effectiveness, which some Veterinarians consider a higher priority than new drug products.

-

Success in the animal health industry is driven by science and innovation. Human health breakthroughs remain a good indicator for future animal health innovation. For example, the adoption and impact of Monoclonal Antibodies (mAbs) in human health is approximately 25%, compared to 5% in animal health. This highlights a clear growth opportunity with a proven path to success. With animal health, Monoclonal Antibodies (mAbs) currently represent $1.2B of the $41B core market.

-

The use of animal protein continues to be scrutinised. However, animal protein demand continues to grow.

-

66% of individuals under 30 care about animal welfare and environmental impact. Therefore, products focused on sustainability remain highly relevant, with climate-neutral farming an essential goal.

-

Similar to other industries, we are seeing an attack on science and innovation, where facts are distorted and/or ignored by small, but vocal social groups. Animal health is a science-based industry. Therefore, the industry must stay unified to educate, promote science and protect innovation.

-

Those who raise and care for animals are naturally passionate and curious. This passion must be considered when entering the market, with a focus on feeling connected and/or being part of something bigger.

-

Pet owner spending is increasing, with growth across “feel-good” items, such as toys, treats and technology. In the US, the younger the pet owner, the more they spend (which is great for the industry).

-

Since 2020, the cost of dog ownership in the US has been rising, with vet services +56%, medications +34%, food and treats +46% and grooming/kennels +52%. The cost of cat ownership in the US has not increased at the same rate but is still +17% overall.

-

Concerningly, the use of vet services is trending down (approximately 1.9% in the US). With the average time between visits being 86 days or 112 days excluding medication collection.

-

$100M products within animal health are classified as a “blockbuster”, with 15 blockbusters currently on the market. We are starting to see the first $1B brands (a family of complimentary products).

-

Science is the ultimate disruptor within animal health, with tremendous opportunities to leverage computational science and Artificial Intelligence (AI) to accelerate the drug discovery process. This trend increases the importance of gaining access to expertise and since 2020 datasets, such as genomics data.

Conclusion

Overall, it was great to be part of the event and to interact with this passionate community!

As I look to the future, I believe the Stonehaven Cozmix Group summarised the near-term opportunities well, covering the following areas across pet and farm.

Pet:

- Monoclonal Antibodies (mAbs)

- Adeno-associated Virus Gene Therapy (AAV)

- CAR-T Cell Therapy

Farm:

- One Health (Epidemics, Antimicrobial Resistance, Antiparasitic Resistance)

- Sustainability (Microbiome on the Rise)

- Scarcity of Skilled Labour

The animal health industry tends to be slower moving, with a focus on micro-innovation vs. revolutions. However, there is a growing appreciation for how technology can be applied across the value chain to deliver compelling outcomes, covering drug discovery, customer engagement and operational effectiveness.

As a result, it is an exciting time to be a technologist working in the animal health industry.

I am excited to see the next wave of breakthrough innovation hitting the market, delivering value to those who raise and care for animals around the world.